At Mission Federal Credit Union, we want to help our members get the right automobile for the right price. We conducted a survey to find out how San Diegans shop for and use their vehicles to learn how to best serve our members. We surveyed 400 San Diegans, ranging in age from 25 to 54, and asked them a variety of questions about automobile ownership, purchases and more. Mission Fed VP Consumer Lending Liz Schrock explains, “What we learned can help us provide the services and customer care our members need to help them navigate through the auto purchase process.”

Since our founding in 1961, Mission Federal Credit Union has proudly served the local community with Bottom Line Auto Loan Rates Every Day to help San Diego County residents succeed. We’re happy to help our members every step of the way as they search for, purchase and finance a new or preowned vehicle.

Our survey showed us:

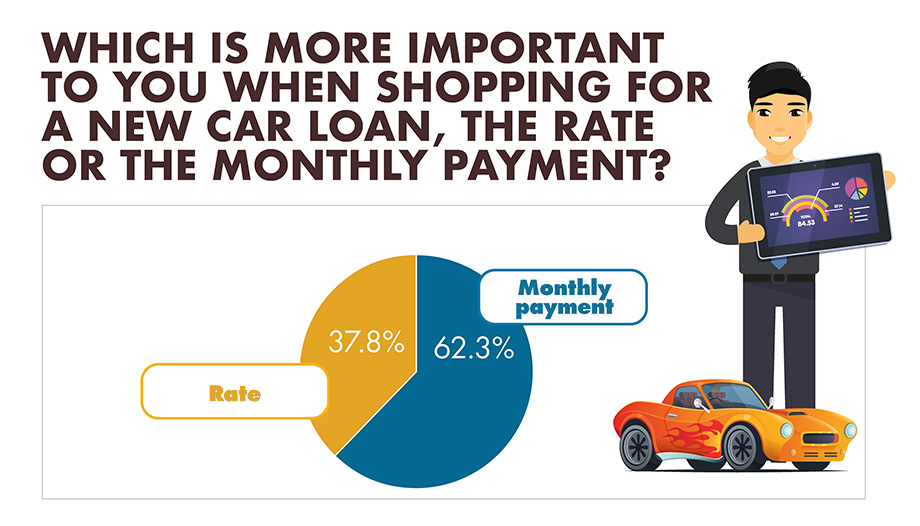

- That monthly payment matters more than the rate to over 62 percent of participants

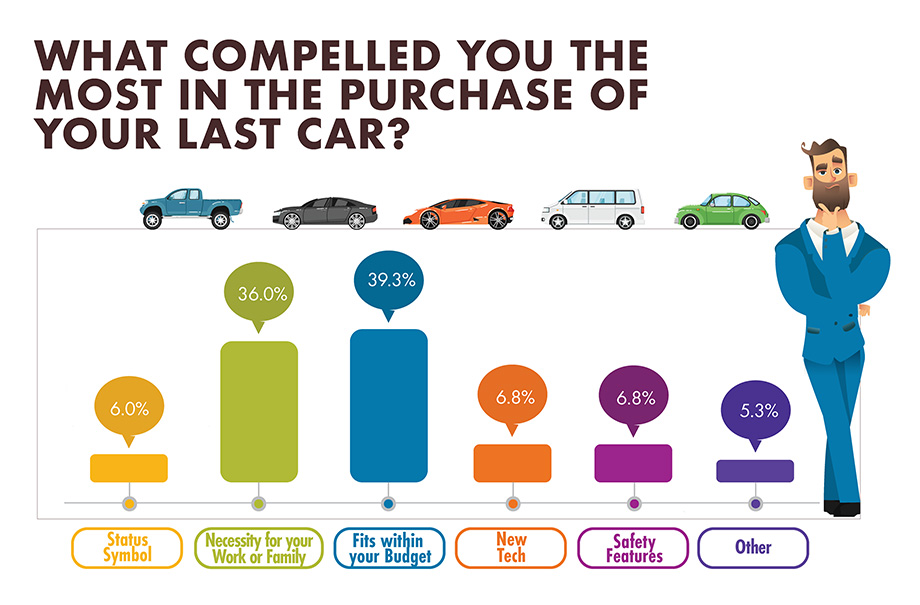

- More than 70 percent of the participants purchased a car that filled a need or fit within their budget

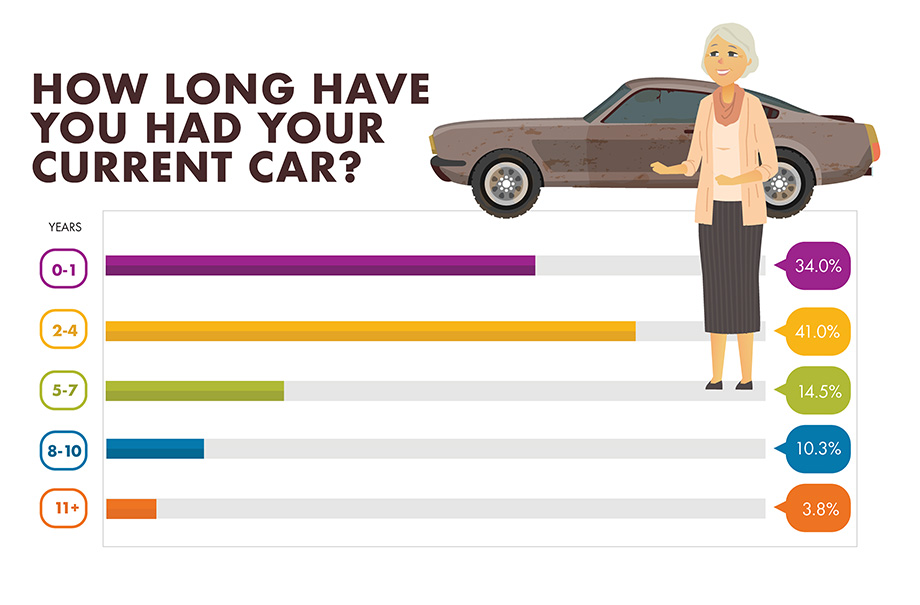

- 75 percent of those surveyed had their current vehicle for four years or less

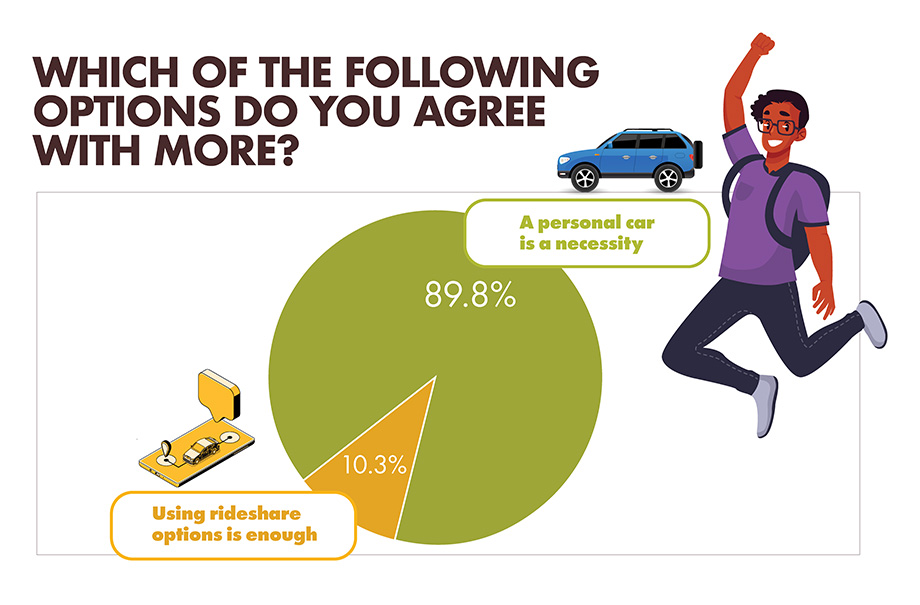

- Almost 90 percent of those surveyed felt a personal car is a necessity

- Over 50 percent of participants plan to lease their next auto purchase with an auto loan

Monthly payments are a significant concern to San Diegans

When it comes to choosing the right auto loan, most people are looking at one of two factors that affect their budget—the auto loan rate and the monthly payment. While the Annual Percentage Rate (APR) ultimately impacts how much you’ll pay over time, 62 percent of survey participants said that the monthly payment is more important to them.

This makes sense, as the monthly payment has the greatest impact on your daily life. Even if you have an excellent rate on your loan, a high monthly payment can be difficult to maintain. As a result, most people are more focused on achieving a manageable monthly payment so their auto loan fits within their budget. If you want to know how much your auto loan payments will be, our Auto Loan Calculator allows you to enter all the information—including your down payment, loan rate and term—in order to calculate your monthly payment.

Schrock suggests, “It’s a good idea to figure out what you can afford to pay monthly, but you should also consider how the APR affects your long-term costs.” The fact is, the higher your loan rate, the more you’ll pay in the long run. Even if you’re able to keep your monthly payment down with a longer term, making smaller payments for a longer period of time could add up to paying more than you need to pay because of the interest.

For example, take a look at two auto loan options for the same car. Even if the APR remains the same (and you’re likely to get a lower APR with a shorter loan term), there’s a significant difference in the interest paid with a longer term.

| Cost of Vehicle | Down Payment | APR | Term Length | Monthly Payment | Total Loan Amount |

|---|---|---|---|---|---|

| $30,000 | $5,000 | 5% | 36 months | $750 | $26,976 |

| $30,000 | $5,000 | 5% | 60 months | $472 | $28,309 |

When you’re exploring auto loans, be realistic about your budget and about how long you want to be making car payments. A low monthly payment may be attractive, but if you have to stretch out your term in order to make the payments, it may be more car than you can afford. Try using our “How Much Car Can I Afford” Calculator to help you make the right choice for your budget.

Before you choose an auto loan, do your research on available APRs and loan terms, as well as whether you can make loan prepayments without a penalty. You’ll also want to consider how quickly your vehicle will depreciate, since it doesn’t make sense to make high payments on a vehicle that’s no longer worth very much.

Mission Fed’s free Auto Loan Guide is a great resource for discovering what information you need and the right questions to ask, as well as some helpful Auto Loan tips, to help you make an informed decision when you apply for your car loan. At Mission Fed, we also offer a variety of perks for shopping with our Preferred Auto Dealer Partners, including Auto Loan Express Check for a faster, easier purchase and 0.25% discount on your approved and qualified Mission Fed Auto Loan rate. Mission Fed can help make your car buying experience as simple as possible.

What matters to San Diegans when purchasing new vehicles

We asked what was most important to our survey participants when buying a new car so we can help meet our members’ needs. The largest group—39 percent of participants—said that fitting within the budget was the most important factor, while 36 percent of participants said that the new vehicle was a necessity for their work or family.

Making a new auto purchase work with your budget is a priority—particularly when that new purchase is essential for your family or your job. Mission Fed can help you keep your Auto Loan budget-friendly to get you in the car you need faster. While traditional banks are typically focused on profit, credit unions like Mission Fed, are able to put people first, saving you time and money. “Since credit unions are smaller, not-for-profit institutions, ”says Schrock, “they can often offer lower interest rates and other perks that help make the process easier for you.”

Getting an Auto Loan with Mission Fed means you can take advantage of a number of different benefits. Here are just some of the perks you can enjoy with a Mission Fed Auto Loan:

- Bottom Line Auto Loan Rates – Lower interest rates mean you could pay less monthly and over the life of your loan.

- Auto Loan Express Check – Auto Loan Express Check makes your Auto Loan car purchase easier and saves you an additional 0.25% on your approved loan rate.

- Autoland – Buy through Autoland with your Mission Fed Car Loan and you’ll enjoy a 0.25% discount on your approved rate.

- Rate Break Program – Earn a potential rate discount of 1% after every six consecutive on-time monthly payments, up to three times, for a potential discount of up to 3%, with a qualifying loan.

- Personalized, Award-winning Service – Because Mission Fed is a local organization, you’ll enjoy individualized customer service and loan experts you can trust and meet with in person. And, because they’re able to get to know you, they can help meet your unique needs.

At Mission Fed, we’re committed to helping you find the right vehicle and the right Auto Loan for you when you need them, and we want to make the process as easy to understand as possible. You are our priority, and our low Car Loan rates, great service and partners like Autoland can help you get the car you need at a price you can afford.

When you need a car, Mission Fed can help

Let’s be honest—most of us love our cars! And beyond that, ridesharing is often only financially viable and convenient when you’re not traveling far. In fact, when we asked whether survey participants felt using rideshare options are sufficient, just over 10 percent of those surveyed said yes. In contrast, nearly 90 percent of the survey participants said that having a personal car is a necessity.

While ridesharing is becoming more popular, most San Diegans prefer to have their own car. Since San Diego County stretches over 4,500 square miles and is larger than Rhode Island and Delaware combined, that’s not surprising. Most people need to travel significant distances for work, school or other needs, and having a car makes that much easier. If ridesharing isn’t enough and you need a car to make your commute easier and more enjoyable, Mission Fed can help you get the Car Loan you need to get driving.

Why San Diegans might opt to get a new vehicle

There are a lot of factors that contribute to someone choosing a new car, but how often are most San Diegans getting a new vehicle? We asked our survey participants how long they had their current car, and 75 percent of participants have had their car for four years or less.

If our community keeps vehicles for less than five years, why might that be? People might choose to get a new car for a variety of reasons, including:

- Necessity after an accident

- The age of the car

- A growing family

- Safety or reliability concerns

- Concerns about depreciation

- Technological advancements

- Financial need

- The desire to upgrade

- Ending lease

No matter why they’ve chosen to get a new vehicle, many people find themselves buying another vehicle before they expected to do so. As a result, the costs could be more than they expected.

If you’ve already purchased a new car before you were financially prepared to do so, Mission Fed Consumer Lending Assistant Manager Cortney Jones said, “Consider refinancing your Auto Loan with Mission Fed. We have competitive rates that could reduce your monthly loan payment. If you’re approved to refinance, you could take advantage of a number of benefits.” Some benefits include:

- Mission Fed’s Bottom Line Interest Rates

- A smaller monthly payment

- Available funds from the equity in your car to pay down other debt

- A deferred payment for the first 90 days

- No prepayment penalty, so you can pay off your loan early without a fee

Discover how an Auto Loan refinance with Mission Fed can get you into a loan with better terms, helping you save money in the long run and making your monthly payments more manageable for your budget.

Mission Fed can help you finance the car that’s right for you

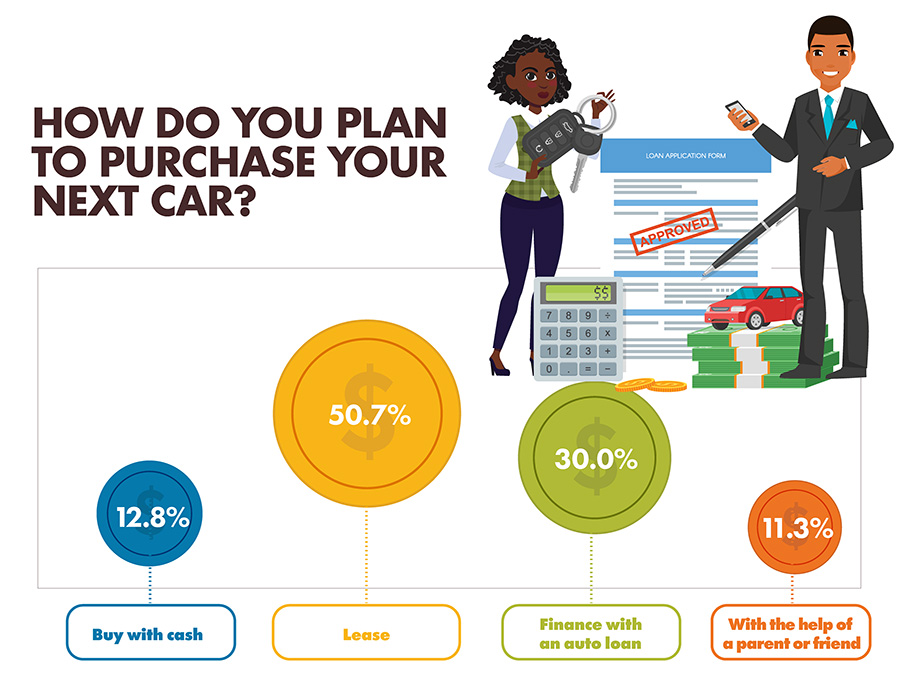

We were interested to learn whether San Diegans plan to lease, buy with cash or finance their next vehicle, and over 50 percent of those surveyed said they plan to finance with an auto loan.

While 13 percent of survey participants plan to lease their next car, it’s important to understand the pros and cons of leasing if you’re considering it. Leasing can be a good option if you like having a new car every couple years or need a lower payment and don’t have a sizeable down payment. Jones also points out, “If you end up loving your leased car, you can choose to purchase it at the end of the lease.” In that case, Mission Fed is happy to help you. Learn how to buy out your lease with an Auto Loan that works for you and your bank account.

A leased car is likely to remain under warranty, so mechanical problems should be covered, but scrapes and excessive wear will not. Also keep in mind that you won’t build equity with your payments, so when you return your leased car you’ll have to start over with a new lease or purchase. Additionally, there are often annual mileage limits and insurance requirements that could end up costing you in the long run.

Why financing is the most popular way to buy a car

Because of the restrictions and lack of equity associated with a lease, many people opt to buy instead. Most buyers prefer to use an Auto Loan rather than pay for the vehicle in cash because it’s difficult to save up the money you need to pay cash for a reliable vehicle in full. Even if you do have that much money saved up, using your entire savings is risky.

Financing, on the other hand, allows you to purchase a new car without a large lump sum of cash. You’ll make monthly payments on your loan, allowing you to build equity, and once you’ve finished your payments, you’ll own the car outright.

At Mission Fed, you could qualify for up to 120 percent financing, which means you can get your new car even if you don’t have any savings for a down payment. Whether you finance the entire cost or put down some cash for a down payment, Mission Fed can help you find an Auto Loan with a great low rate and a term that works for you and your budget.

Our Car Loans offer:

- Fast application in the branch, by phone or online with a quick response

- Bottom Line Auto Loan Rates Every Day

- Flexible terms from 36 months to 84 months

- Financing up to 120 percent

- Potential 0.25% rate discounts with Autoland or Auto Express Loan Check

- Easy payment options, including online, by phone or via automatic withdrawal

- Mission Skip-A-Pay for approved, qualified Loans

Before you apply for your Auto Loan and buy the car you want, discover more about how to choose the right car for you and your budget, how to find the right loan and what a Mission Fed Auto Loan can do for you. Jones suggests, “Check out our Auto Loan Guide to answer many of your questions and help you feel confident and informed as you begin the buying process.”

You can also use any of our Auto Loan Calculators to discover:

- Should you lease or purchase a car?

- How much will your auto payments be?

- Should you take a rebate or low-cost financing?

- Should you accelerate your auto payments?

- How much car can you afford?

Whether you’re applying for your very first Auto Loan and aren’t sure where to start, or whether you’re a seasoned buyer looking to upgrade your vehicle, Mission Fed is here to help you every step of the way. Jones says, “The results of this survey help us better understand how San Diegans are using and purchasing their vehicles so that we can help make the process smoother and easier for you.”

Stop by any of our more than 30 branches today and discover how we’re putting people before profit when it comes to helping you find the right Auto Loan for you. We want to help you get into the car you want at the monthly payment you need, without paying too much. At Mission Fed, your success is our bottom line.

The content provided in this blog consists of the opinions and ideas of the author alone and should be used for informational purposes only. Mission Federal Credit Union disclaims any liability for decisions you make based on the information provided. References to any specific commercial products, processes, or services, or the use of any trade, firm, or corporation name in this article by Mission Federal Credit Union is for the information and convenience of its readers and does not constitute endorsement, control or warranty by Mission Federal Credit Union.