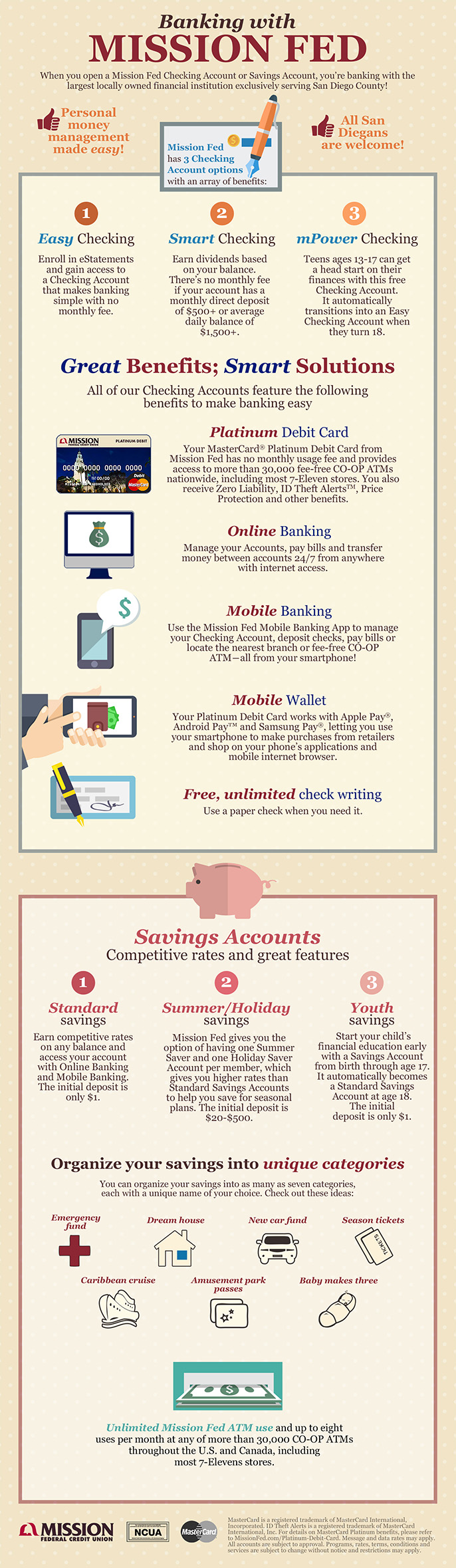

Personal money management made easy with Mission Fed Checking Accounts and Savings Accounts.

When you open a new Checking Account or Savings Account, you’re banking with the largest locally owned financial institution exclusively serving San Diego County!

Mission Fed has three Checking Account options (as well as credit union business accounts) with an array of benefits:

Easy Checking. Enroll in eStatements and gain access to a Checking Account that makes banking simple with no monthly fee.

Smart Checking. Earn dividends based on your balance. There’s no monthly fee if your account has a monthly direct deposit of $500+ or average daily balance of $1,500+.

mPower Checking. Teens ages 13-17 can get a head start on their finances with this free Checking Account. It automatically transitions into an Easy Checking Account when they turn 18!

All of our Checking Accounts feature the following benefits to make banking easy:

Platinum Debit Card. Your Mastercard® Platinum Debit Card from Mission Fed has no monthly usage fee and provides access to nearly 30,000 fee-free CO-OP ATMs nationwide, including most 7-Eleven stores.

You also receive Zero Liability, ID Theft Alerts™, Price Protection and other benefits.

Online Banking. Manage your Accounts, pay bills and transfer money between accounts 24/7 from anywhere with internet access.

Mobile Banking. Use the Mission Fed Mobile Banking App to manage your Checking Account, deposit checks, pay bills or locate the nearest branch or fee-free CO-OP ATM—all from your smartphone!

Mobile Wallet. Your Platinum Debit Card works with Apple Pay®, Android Pay™ and Samsung Pay®, letting you use your smartphone to make purchases from retailers and shop on your phone’s applications and mobile internet browser.

Free, Unlimited Check Writing. Use a paper check when you need it.

Savings Accounts. Competitive rates and great features.

Standard Savings Account. Earn competitive rates on any balance and access your account with Online Banking and Mobile Banking. The initial deposit is only $1.

Organize your savings into unique categories. You can organize your savings into as many as seven categories, each with a unique name of your choice. Check out these ideas:

- Emergency Fund

- Dream house

- New car fund

- Season tickets

- Baby makes three

- Caribbean Cruise

- Amusement Park passes

ATM use. Unlimited Mission Fed ATM use and up to eight uses per month at any of nearly 30,000 CO-OP ATMs throughout the U.S. and Canada, Including most 7-Elevens stores.

Summer or Holiday Saver Account. Mission Fed gives you the option of having one Summer Saver and one Holiday Saver Account per member, which gives you higher rates than Standard Savings Accounts to help you save for seasonal plans. The initial deposit is $20-$500.

Youth Savings Account. Start your child’s financial education early with a Savings Account from birth through age 17. It automatically becomes a Standard Savings Account at age 18. The initial deposit is only $1.

Visit www.MissionFed.com to open an account today. All San Diegans are welcome!

For more information on how your local nonprofit can partner with Mission Fed, visit www.MissionFed.com/Nonprofits.

Sources:

https://www.missionfed.com/checking

https://www.missionfed.com/accounts

https://www.missionfed.com/savings

Mastercard is a registered trademark of Mastercard International, Incorporated. ID Theft Alerts is a registered trademark of Mastercard International, Inc. For details on Mastercard Platinum benefits, please refer to MissionFed.com/Platinum-Debit-Card. Message and data rates may apply. All accounts are subject to approval. Programs, rates, terms, conditions and services are subject to change without notice and restrictions may apply.