Buying a home is a big step, and when you’re looking to buy a home in San Diego in today’s market, it can feel particularly intimidating. Mission Federal Credit Union is here to help. We wanted to learn more about how to provide the resources San Diegans need to make buying a home happen for them.

To learn more, we surveyed 400 San Diegans, ranging in age from 25 to 54, to find out what they think of current trends in home ownership in San Diego. “With this knowledge,” says Mission Fed 1st VP Real Estate Operations Vince Nowicki, “we’re able to better help members take the next step and become homeowners, without overextending themselves.” Mission Fed puts people before profit, and we want to show members that owning a home is more feasible than you might think.

Our key survey findings:

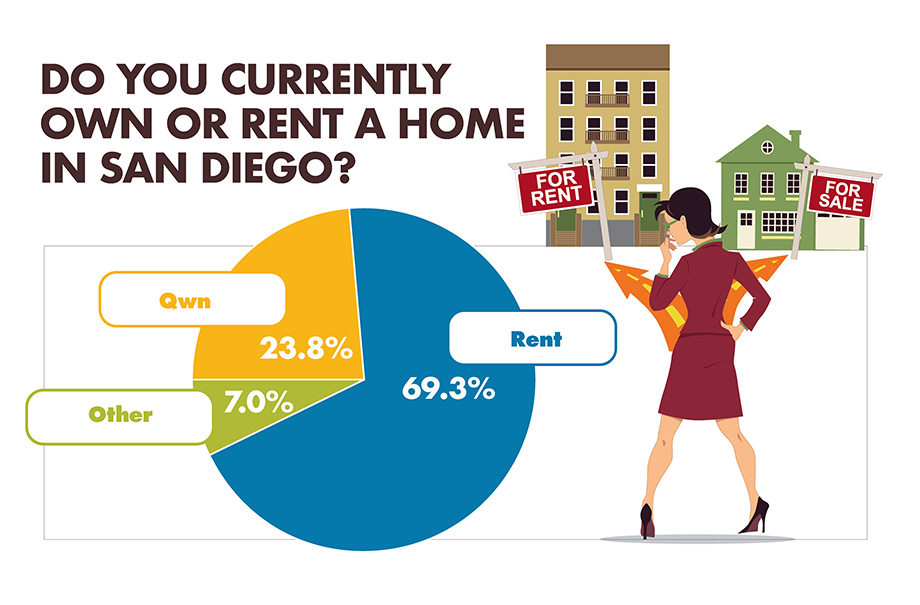

- 69.3 percent of those surveyed rent rather than own their home in San Diego

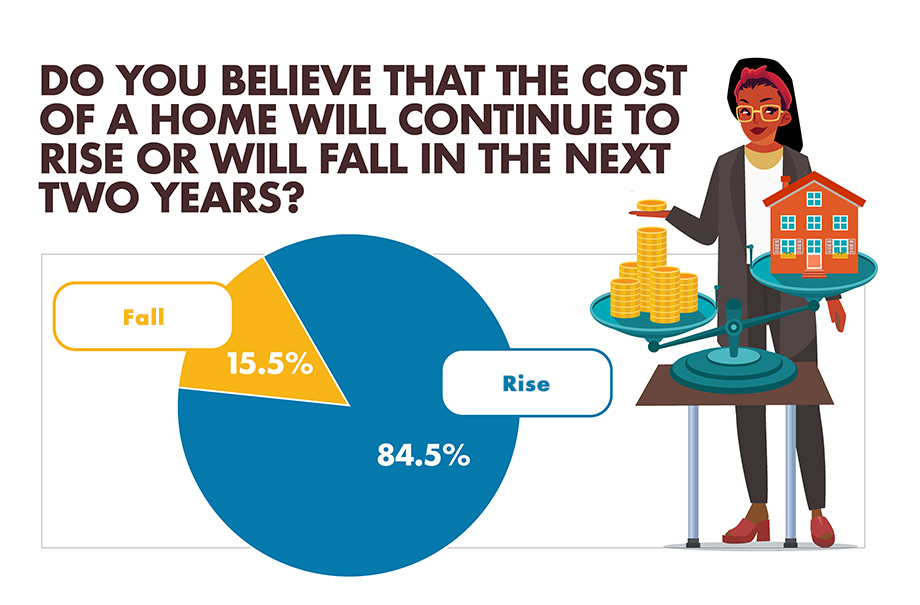

- 84.5 percent of survey participants believe the cost of a home will continue to rise over the next two years in San Diego

- 61.1 percent of those surveyed say home prices have been the biggest challenge with owning a home in San Diego

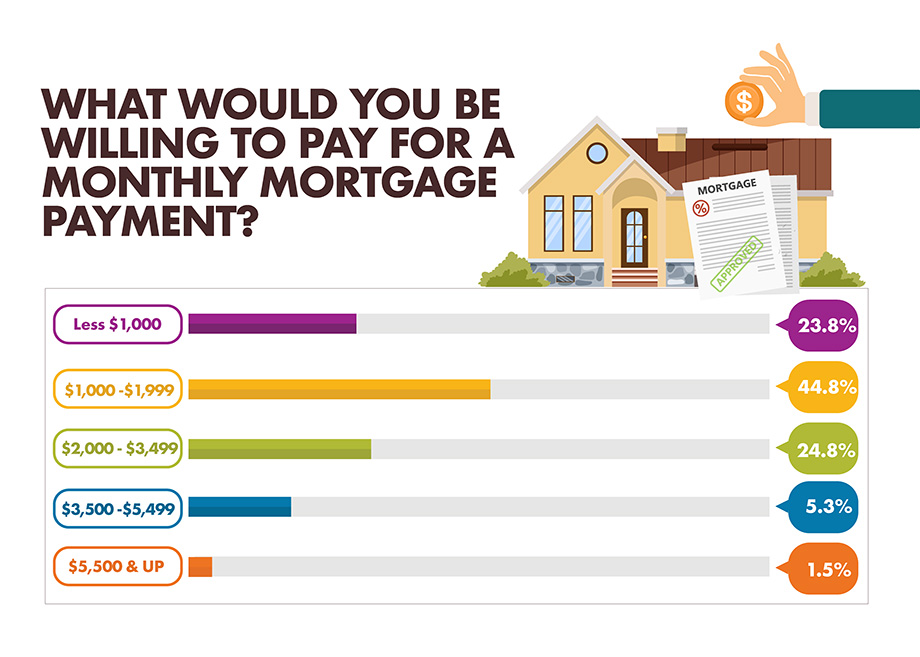

- 44.8 percent of survey participants are willing to pay $1,000 to $1,999 for a monthly mortgage payment

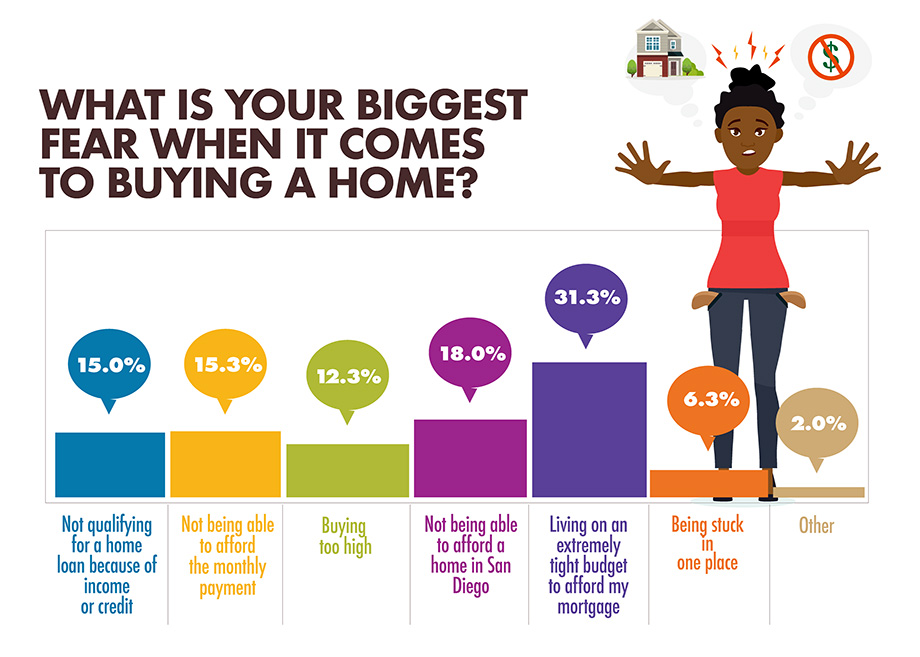

- 31.1 percent of survey participants said not being able to afford a home in San Diego is their biggest fear when it comes to buying a home

Renting versus owning in San Diego

The majority of those surveyed—nearly 70 percent—rent a home in San Diego, while just 23.8 percent own their home. “These results were not surprising to us,” explained Nowicki, “considering the state of the market.”

California is a consistently booming market. People are always moving here to enjoy the warmer weather or the incredible landscape, but it’s your basic supply and demand problem: There just isn’t enough housing for everyone, and California hasn’t built enough housing to keep up with the growing number of people living here. San Diego County makes up over 8 percent of the state’s population growth since 2010. Single-family rentals are the fastest-growing market in California, while the number of owned single-family homes dropped dramatically during the Great Recession and never quite recovered.

While we understand that buying is not always an option for everyone, Nowicki wants our members to know that, “Owning a home is more achievable than you think. Plus, it makes more financial sense to invest in a home loan and build equity on your own home, rather than spending money on rent and never seeing a return.” Mission Fed offers many resources to help make buying a reality for more people. Whether you’re a first-time homebuyer or just moving to San Diego from a place where the cost of living is much lower, we’re here to help you get the home you’ve always wanted. Keep reading to learn more about the kinds of resources Mission Fed provides to help you buy the right home.

How the housing market affects San Diegans’ willingness to buy

The current cost of buying a home in the San Diego area makes many potential buyers nervous, and of those surveyed, 84.5 percent believe that the cost of homes in the San Diego area will continue to rise.

Considering this, it’s not hard to understand why many people are hesitant to buy. Buying at the height of the market is daunting, and most people see rising costs as the main hindrance in buying a home. If you feel like home prices are too high or you can’t afford to buy a home, you’re not alone. With the majority of survey participants anticipating increasing prices, Mission Fed wants to help potential buyers explore their options and discover whether buying is within their budget.

The greatest challenge for San Diegans and homeownership

We wanted to know what San Diegans feel is the biggest challenge when it comes to buying a home in San Diego. Over 61 percent of survey participants said that home prices were the greatest challenge for them, while over 23 percent said it was their income level. When you take both of those answers into account, it’s easy to see why many people feel homeownership is out of reach.

Mission Fed wants you to know that it doesn’t have to be. Homeownership can be within your reach, and we can help make that possible. Learn more about our variety of Home Loan options with Bottom Line Rates, and our helpful programs and educational resources geared toward making buying a home more affordable than before.

First-time buyers can take advantage of our First-Time Homebuyer Seminars, where you’ll learn:

- The benefits and responsibilities of owning a home

- How to understand your FICO score and the contents of your credit report

- What to decide on before you even start looking for a house

- What you can really afford when it comes to home prices, monthly payments and more

- Common misconceptions when it comes to buying a home

- About Mortgage Loans and how to navigate the application process

If you’re an experienced homeowner, but still worry about affordability in San Diego, we have options like the 5/5 ARM Home Loan. This loan allows you to save money by covering your closing costs up to $10,000. You’ll be able to write a smaller check at closing and keep your initial payments lower for the first five years. You could even get your Mortgage Insurance covered if you have a low down payment. Mission Fed VP Real Estate Diana Clegg explains, “Rates are subject to increase or decrease once every 5 years, based on the weekly average of the 5 Year Constant Maturity Treasury (CMT) index rate, as made available by the Federal Reserve Board, plus a margin of 2.75%. However, the maximum cap of 2% every 5 years and 5% over the life of the loan means you know what to expect, even with an adjustable rate.”

No matter what kind of Home Loan you choose at Mission Fed, you can take advantage of our Bottom Line Rates every day and find options tailored to suit your budget and your financial goals. Here are just some of the advantages of getting a Mission Fed Mortgage Loan:

- Apply for your Home Loan with our fast and easy [apply-mortgage:body~online application] with an answer in minutes

- Access to competitive fixed and adjustable rate mortgages (ARMs)

- Ability to refinance and cash out your loans

- Access to low down payment loans

- Access to first-time homebuyer programs

In addition, Mission Fed offers a number of programs to help you save money and time when you buy a home.

Still not sure you can truly afford a home in San Diego? Mission Fed offers even more educational resources to help you see that you can. Here’s what we provide to help you on your home-buying journey.

- Our in-depth Home Loan Guide, created to help you:

- Understand important loan and buyer terminology

- Access essential information for first-time buyers

- Avoid common mistakes

- Determine what you can afford

- Learn what to do once you own a home

- Our Credit Guide, which can help you learn:

- How to check your credit

- How to improve your credit score

- What credit history you need to get a home loan

- Additional information about what constitutes good and bad credit and how to protect yourself against fraud

- Saving tools via Online Banking like:

- Savings goals and budgets, so you can be intentional about saving money

- Realtor Days, where you can meet and consult with a realtor in person

- Home Loan Calculators to help you discover:

- How much home you can afford.

- Whether you should refinance your home.

- Differences in cost when comparing mortgages (i.e. 15, 20, 30 year).

- Whether you should pay discount points.

- Whether you should make extra payments on your mortgage.

- How much of a down payment you should make on your new home.

- An estimate of what your mortgage payment will be.

- What the Loan to Value Ratio of your home is.

How much are San Diegans willing to pay per month for a mortgage?

Once you discover you actually can afford to buy a house, it’s time to decide what you’re willing to pay each month. Since that number will have the most profound impact on your day-to-day life, it’s a good idea to be clear on what you’re comfortable paying. When we asked our survey participants what they were willing to pay for a monthly mortgage payment, 44.8 percent said they were willing to pay $1,000 to $1,999 per month. 23.8 percent were only willing to pay less than $1,000, while 24.8 percent were willing to pay $2,000 to $3,499 per month.

While keeping a mortgage payment under $1,000 is going to be tricky in the San Diego area without a sizeable down payment, Clegg explains that “Keeping it between $1,000 and $1,999, as most people surveyed would prefer, is doable.” The average price of homes sold in San Diego is currently about $590,000, but if you have a decent down payment saved or if you have equity in your current home, you could keep your monthly payment within that range.

Even without a large down payment, keeping a monthly payment between $2,000 and $3,499 is attainable. Use our Mortgage Payment Calculator to run your own numbers and find out how you can keep your monthly payment in a range that’s comfortable for you. Using the calculator, you can try different combinations of down payment amounts and loan types to see how the payment varies.

How Mission Fed can help ease San Diegans’ biggest fears about buying a home

Considering the market in San Diego, Mission Fed was interested in finding out what San Diegan’s were most afraid of when it comes to buying a home locally. 31 percent of those surveyed said that not being able to afford a home in San Diego was their biggest fear. The next largest group, at 18 percent, said that living on an extremely tight budget to afford their mortgage was their greatest fear.

If you’re in one of these groups, you’re not alone. With the current market value, many people are feeling anxious about being able to buy a home. Mission Fed can help you find the best Mortgage Loan option to help you get in the home you want at a price you can afford. We can work with you to help you learn which loan fits your needs best, while also keeping your payment within your budget. Whether you need a low down payment option or a first-time homebuyer option, you can trust Mission Fed to help you find a loan that works best for you. In addition to the variety of loans we offer, we want to help provide you with home purchasing power. Here are just a few more reasons to choose Mission Fed for your Home Loan:

- We service most of our loans in-house, so you can trust us to have up-to-date information and local customer service. Payments go directly to Mission Fed, and you can come directly to any of our Mission Fed branches for personalized assistance.

- Bottom Line Rates every day.

- First-time homebuyer programs and seminars to help you through the process.

- Our 5/5 ARM Loan, which can help you save on closing costs and offers a low fixed rate for the first five years of the loan. Rates can increase or decrease once every five years based on the weekly average of the 5 Year Constant Maturity Treasury (CMT) index rate, as made available by the Federal Reserve Board, plus a margin of 2.75%. There’s a maximum cap of 2% every five years and 5% over the life of the loan, so you can anticipate your total costs.

- Our program to pay your private mortgage insurance (PMI) on 5/5 ARM Loans up to $625,500, with down payments as low as 5 percent.

- Mission Fed is the largest locally based financial institution exclusively serving San Diego County, and we’re focused on giving back to our community.

- Mission Fed is the proud recipient of the 2017 BBB Torch Award for Ethics, category 500+ employees, from the Better Business Bureau® serving San Diego, Orange and Imperial Counties. This award recognizes Mission Fed’s commitment to integrity, customer service and community involvement. We believe in prioritizing people over profit. We’re proud of the work we do in our community, and especially proud to help members reach their financial goals.

Mission Fed can help you get the home you want

Mission Fed knows that buying a home is a big step, and we’re here to help you every step of the way. As Clegg says, “Homeownership is an important step in securing your financial future, and we’ll be by your side to help you navigate the buying process.” When it’s time for you to begin the Home Loan and buying process, stop by and discover how Mission Fed can lend a hand. Between our excellent customer service, valuable resources and great rates and other savings, you’ll be on your way to a new home in no time. We look forward to assisting however we can.

The content provided in this blog consists of the opinions and ideas of the author alone and should be used for informational purposes only. Mission Federal Credit Union disclaims any liability for decisions you make based on the information provided. References to any specific commercial products, processes, or services, or the use of any trade, firm, or corporation name in this article by Mission Federal Credit Union is for the information and convenience of its readers and does not constitute endorsement, control or warranty by Mission Federal Credit Union.