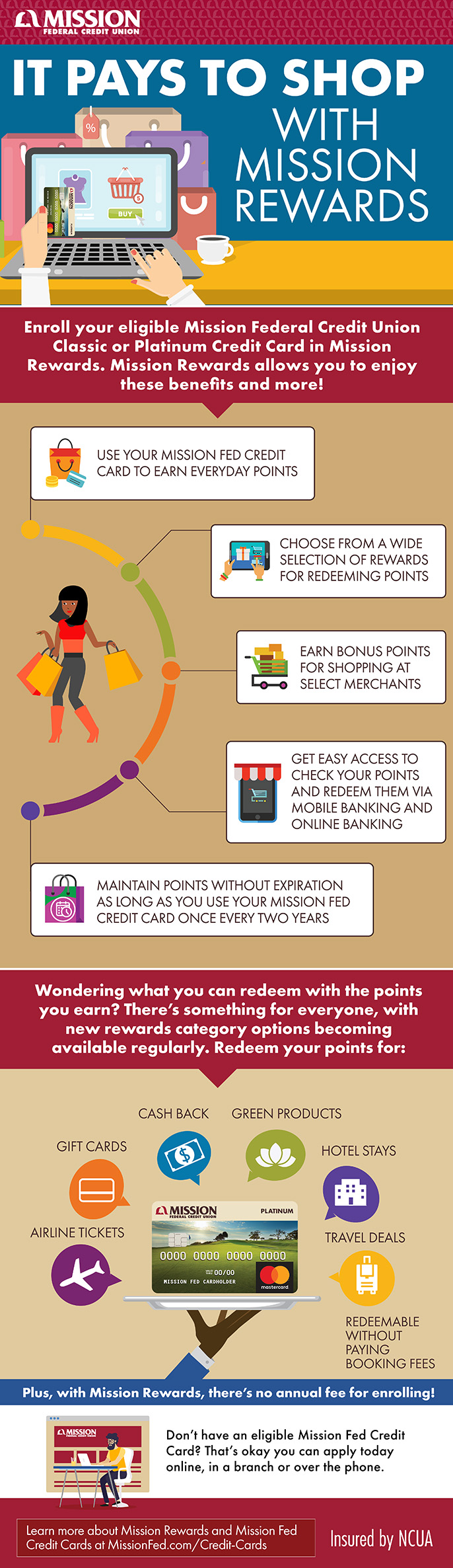

Enroll your eligible Mission Federal Credit Union Preferred Platinum Credit Card in Mission Rewards. Mission Rewards allows you to enjoy these benefits and more:

Preferred Platinum Credit Card in Mission Rewards. Mission Rewards allows you to enjoy these benefits and more:

- Use your Mission Fed Credit Card to earn everyday points

- Choose from a wide selection of rewards for redeeming points

- Earn bonus points for shopping at select merchants

- Get easy access to check your points and redeem them via Mobile Banking and Online Banking

- Maintain points without expiration as long as you use your Mission Fed Credit Card once every two years

Wondering what you can redeem with the points you earn? There’s something for everyone, with new rewards category options becoming available regularly. Redeem your points for:

- Cash back

- Gift cards

- Travel deals—redeemable without paying booking fees

- Airline tickets

- Hotel stays

- Green products

Plus, with Mission Rewards, there’s no annual fee for enrolling!

Don’t have an eligible Mission Fed Credit Card? That’s okay you can apply today online, in a branch or over the phone.

Shopping with your Mission Fed Credit Card really does pay! Your success is our bottom line, and that includes helping you make the most out of your purchases. Check out our infographic to learn more.

Learn more about three of these common scams with the infographic below.

Click the infographic below to view the enlarged version and visit your local branch.

The content provided in this blog consists of the opinions and ideas of the author alone and should be used for informational purposes only. Mission Federal Credit Union disclaims any liability for decisions you make based on the information provided. References to any specific commercial products, processes, or services, or the use of any trade, firm, or corporation name in this article by Mission Federal Credit Union is for the information and convenience of its readers and does not constitute endorsement, control or warranty by Mission Federal Credit Union.